In sub-Saharan Africa, trust in the tax revenue office is waning.

By

Sevidzem Courage Mbiydzenyuy (PhD)

Lecturer, University of Bamenda

Secretary General, LoRDA Research Center

&

Loah Maisels Sangli

Research Fellow, LoRDA Research Center

Opening

The tax system is a key formal institution with a unique role in the social contracts between people and governments, as well as an essential source of revenue for governments to fund public devices and programs that benefit the community. Mobilizing domestic revenue is critical for developing countries to achieve the national development objectives and sustainable development goals. Tax non-compliance, such as tax evasion and tax avoidance, is a major challenge in sub-Saharan Africa(SSA). Research and policymakers have generally focused on law-based compliance and the role of formal rules and institutions such as audits and penalties to reduce tax evasion, referred to as enforced compliance. As trust and power are at intermediate levels, a downward trend may occur, since with trust undermined, a display of power (such as audits and fines) creates even more distrust, leading to non-compliance of tax. Thus, enforced compliance can only work well in an atmosphere characterized by trust. This very trust is in serious crisis in the SSA, compromising tax compliance and hindering the delivery of needed services to the economy. The LoRDA Research Centre dug deep into the innovative Afrobarometer database to shed more light on the worsening crisis of trust in tax authorities and offices in SSA. The Research Centre’s calculations, based on the opinions of sampled taxpayers in 31 SSA countries, indicate that the trust crisis in the tax office has been on the increase over time in Cameroon and most SSA countries, posing a significant threat to the mobilization of tax revenue and the delivery of services in the economies. The Research Centre recommends several ways to rebuild confidence, drawing on good practices from other countries that have succeeded in building this trust.

Keywords: Trust in the tax office, social contract, service delivery, and sub-Saharan Africa

I-BACKGROUND AND STYLIZED FACTS ON THE SOCIAL CONTRACT THEORY

The tax system is a key formal institution that plays a unique role in social contracts between people and governments, as well as an essential source of revenue for governments to fund public devices and programs that benefit the community. The relationship between taxpayers and tax authorities is pivotal in fostering a culture of voluntary compliance and civic responsibility. This relationship is expected to be seasoned or nurtured by mutual trust. The issue of trust in tax revenue offices as public institutions has gained significant attention across Sub-Saharan Africa. In spite of the fact that these offices, play a crucial role in the economy and should deserve cooperation or compliance from the citizens, there is a growing concern that trust in these offices is waning. This decline in trust can have far-reaching implications, not only for tax compliance but also for the broader socio-economic landscape of a country.

Mobilising domestic revenue is critical for developing countries to achieve the national development objectives and sustainable development goals. However, tax noncompliance in the form of tax evasion and tax avoidance are major challenges in sub-Saharan Africa (Julius O. et al., 2023; Kimea AJ. et al., 2023). Research and policymakers have generally focused on law-based compliance and the role of formal rules and institutions such as audits and penalties to reduce tax evasion, referred to as enforced compliance. In recent years, informal norms and beliefs motivating taxpayers’ compliance, particularly trust, have received more attention, making voluntary compliance more important in countries where enforcement capacity is weak. Trust in the tax departments refers to the confidence that tax payers have in the integrity, transparency, accountability, and effectiveness of tax authorities. This trust encompasses the belief that tax departments and the government will administer tax laws fairly, allocate resources efficiently, and use tax revenues for public benefit. Trust plays a crucial role in enhancing tax compliance among citizens. When taxpayers believe that their government is fair, transparent, and efficient in utilizing tax revenues, many are likely to fulfill their tax obligations. The social contract theory, which posits that individuals either explicitly or implicitly consent to surrender some freedom and submit to the authority of the state in exchange for their remaining rights, supports this affirmation. This mutual agreement forms the basis for societal cooperation. Therefore, we can view taxation as a form of mutual obligation, where citizens contribute to society’s collective wellbeing by paying taxes, and governments pledge to use these funds responsibly and transparently. A strong social contract characterised by trust leads to higher levels of voluntary compliance (Bahl & Bird, 2008; Torgler, 2007; Tsilly, 2024). When tax authorities act transparently and accountably, they reinforce the idea that paying taxes is part of a reciprocal relationship benefiting society as a whole, thereby making tax compliance easy.

Trust fosters social and economic progress. The theoretical work emphasises the importance of trust in the government and in tax administration to boost tax compliance. Kirchler, Wahl, and Hoelzl (2008) developed the Slippery Slope framework, in which trust in tax authorities is the primary determinant of tax compliance on the one hand and authority power on the other. For them, a climate of trust encourages cooperation and voluntary compliance, whereas a climate of resistance is characterised by an unwillingness to cooperate and requires a strong display of authority to ensure compliance (enforced compliance). The erosion of trust in tax revenue offices can be attributed to several factors, including perceived corruption, inefficiency, and lack of transparency. These issues undermine the willingness of citizens to comply with tax obligations, which in turn affects government revenue and the ability to fund essential public services. The framework suggested by Kirchler et.al (2008) posits that maintaining high compliance requires a high level of trust and power. As soon as trust and power are at intermediate levels, a downward trend may occur because, with trust undermined, a display of power (such as audits and fines) creates even more distrust, leading to non-compliance with taxes (Kirchler, 2007). Thus, enforced compliance can only work well in an atmosphere characterised by trust. In SSA, there is a serious crisis of trust. The LoRDA Research Center dug deep into the innovative Afrobarometer database to shed more light on the worsening crisis of trust in tax authorities and offices by undertaking a cross-country appraisal of the diminishing trust in tax revenue offices in Sub-Saharan Africa. By examining the perceptions and attitudes of citizens towards these institutions, we identify key areas for reform and improvement.

II. CRISIS OF TRUST IN THE TAX REVENUE OFFICE: A CROSS-COUNTRY APPRAISAL

According to LoRDA Research Center calculations, the crisis of trust in the tax office in SSA has worsened over the years. We compute the complete lack of trust, also known as ‘the complete distrust score,’ as a percentage score based on the opinions of sampled taxpayers in 31 SSA countries. Over the years, the complete lack of trust (no trust at all) has increased steadily. On average, the complete lack of trust registered a percent frequency score of 20.6% in 2011/2013, increased to 21.5% in 2014/2015, and jumped to 24.4% in 2019/2021.

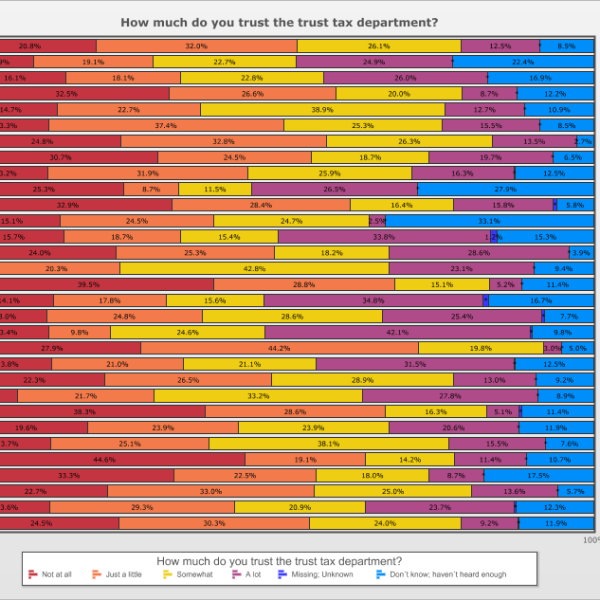

Figure 1: Afrobarometer surveys R5: 2011/2013

Figure 1 shows that only two (2) out of the thirty-one (31) SSA countries had a ‘complete distrust score’ below 10% during the 2011/2013 period.

- Mauritius with 4.5%

- South Africa with 8.4%

14 (fourteen) out of the 31 countries had a ‘complete distrust score’ below the 2011/2013 African average of 20.6%, namely:

- Botswana with 10.9%

- Burkina Faso with 16.1

- Cape Verde with 14.7%

- Cote d’Ivoire with 13.3%

- Kenya with 13.2%

- Madagascar with 15.1%

- Malawi with 15.7%

- Mozambique with 14.1%

- Namibia with 13%

- Niger with 13.4%

- Senegal with 13.8%

- Swaziland with 19.6%

- Tanzania with 13.7%

- Zambia with 13.6%

The following countries (15 out of 31 countries), amongst which is Cameroon, registered a score above 2011/2013 SSA average, namely:

- Benin with 20.8%

- Cameroon with 32.5%

- Ghana with 24.8%

- Guinea with 30.7%

- Lesotho with 25.3%

- Liberia with 32.9%

- Mali with 24%

- Morocco with 39.5%

- Nigeria with 27.9%

- Sierra Leone with 22.3%

- Sudan with 38.3%

- Togo with 44.6%

- Tunisia with 33.3%

- Uganda with 22.7%

- Zimbabwe with 24.5%

In the period 2011/2013, Mauritius was the country with the highest level of trust, and Togo the country with the lowest level of trust. Morocco, Sudan, Tunisia, Liberia, Cameroon, and Guinea had a complete distrust score of above 30%.

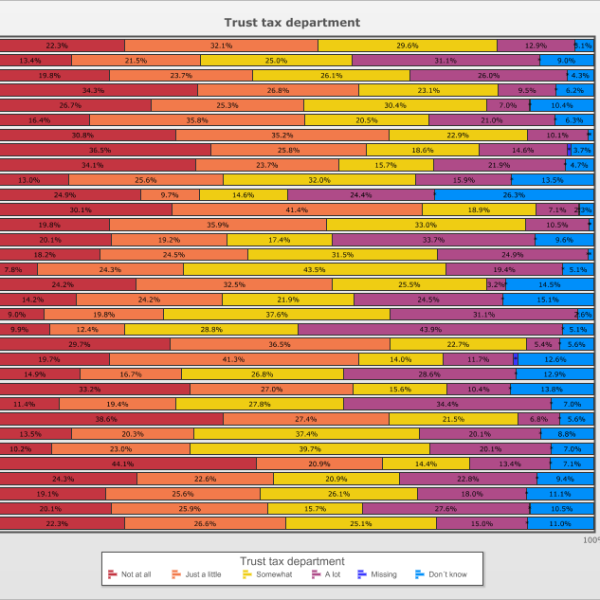

Figure 2: Afrobarometer surveys R6: 2014/2015

The SSA average of trust in the tax department increased to 21.5% in 2014/2015 from 20.6% in 2011/2013, according to Figure 2. In the period 2019/2021, only three (03) out of the thirty-four (33) SSA countries had a ‘complete distrust score’ below 10%, namely:

- Mauritius with 7.8%

- Namibia with 9%

- Niger 9.9%

In 2014/2015, 15(Fifteen) out of the 34 countries had a ‘complete distrust score’ below the 2014/2015 African average of 21.5%, namely:

- Botswana with13.4%

- Burkina Faso with 19.8%

- Cote d’Ivoire with 16.4%

- Kenya with 13.0%

- Madagascar with 19.8%

- Malawi with 20.1%

- Mali with 18.2%

- Mozambique with 14.2%

- Sao Tome and Principe with 19.7%

- Senegal was below average with 14.9%

- South Africa with 11.4%

- Swaziland with 13.5%

- Tanzania with 10.2%

- Uganda with 19.1%

- Zambia with 20.1%

The following countries (15 out of 33), including Cameroon, registered a score higher than the 2014/2015 SSA average of 21.5%.

- Benin with 22.3%

- Cameroon with 34.3%

- Cape Verde with 26.7%

- Gabon with 30.8%

- Ghana with 36.5%

- Guinea with 34.1%

- Lesotho with 24.9%

- Liberia with 30.1%

- Morocco with 24.2%

- Nigeria with 29.7%

- Sierra Leone with 33.2%

- Sudan with 38.6%

- Togo was above average with 44.1%

- Tunisia with 24.3%

- Zimbabwe with 22.3%

In the period 2014/2015, Mauritius was still the country with the highest level of trust in the tax office in SSA, and Togo the country with the lowest level of trust. Gabon, Sudan, Sierra Leone, Liberia, Ghana, Cameroon, and Guinea had a complete distrust score of above 30%.

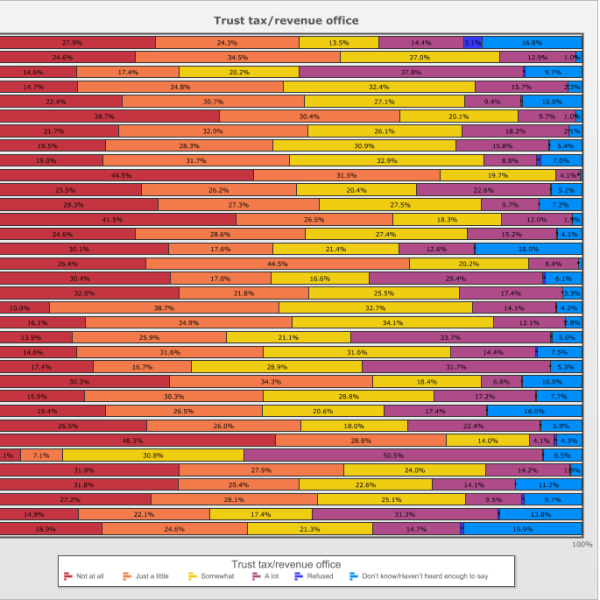

Figure 3: Afrobarometer surveys R8:2019/2021

From Figure 1, in the period 2019/2021, only one (1) out of the thirty-four (34) SSA countries had a ‘complete distrust score’ below 10%, namely:

- Tanzania with average of 5.1%

Fourteen (14) out of the 34 countries had a ‘complete distrust score’ below the 2019/2021 African average of 24.4%, namely:

- Botswana with 14.6%

- Burkina with 14.7%

- Cape Verde with 22.4%

- Cote d’Ivoire with 21.7%

- Ethiopia with 19.5%

- Eswatini with 19%

- Morocco with 16.1%

- Mozambique with 13.9%

- Namibia with 14.6%

- Niger with 17.4%

- Senegal with 15.9%

- Sierra Leone with 19.4%

- Zambia with 14.9%

- Zimbabwe with 18.9%

The following countries (18 out of 34 countries) registered a score above 2019/2021 SSA average of 24.4%, namely:

- Angola with 27.9%

- Benin with 24.6%

- Cameroon with 38.7%

- Gabon with 44.5%

- Gambia with 25.5%

- Ghana with 28.3%

- Guinea with 41.5%

- Kenya with 24.6%

- Lesotho with 30.1%

- Liberia with 30.4%

- Malawi with 30.4%

- Mali with 32.0%

- Nigeria with 30.3%

- South Africa with 26.5%

- Sudan with 48.3%

- Togo with 31.9%

- Tunisia with 31.8%

- Uganda with 27.2%

In the period 2019–2021, Tanzania had the highest level of trust in the tax office in SSA, and Sudan had the lowest level of trust. Cameroon, Gabon, Guinea, Lesotho, Liberia, Malawi, Mali, Nigeria, Togo, and Tunisia had a complete distrust score of above 30%.

Based on the aforementioned figures, it is evident that the levels of distrust in most countries continue to rise annually. Cameroon constantly scored records above average, from 32.5% in 2011/2013 to 34.3% in 2014/2015, which later increased to 38.7% in 2019/2021. These scores indicate a high level of complete lack of trust in Cameroon’s tax department over the years.

III. WHAT IS THE WAY FORWARD FOR CAMEROON AND OTHER SSA COUNTRIES?

Building confidence in tax systems in Cameroon and other SSA countries as a whole is crucial for enhancing compliance and fostering a positive relationship between taxpayers and tax authorities, thereby enhancing revenue generation ,fostering economic development and good governance.

Several ways to rebuild confidence, drawing on good practices from other developed countries, are listed below:

Transparency and communication

Many developed countries, such as Sweden and Finland, prioritise transparency in their tax systems. They offer lucid details on the collection and utilization of taxes, along with comprehensive reports on public spending. By making tax information accessible and understandable, taxpayers can see the direct benefits of their contributions, which boosts trust (OECD, 2019).

Fairness in Tax Administration

Treating all taxpayers equitably reduces perceptions of bias and discrimination, thereby boosting compliance (Feld & Frey, 2002). Countries like Canada have implemented measures to ensure fairness in tax assessments and audits. This includes providing clear guidelines on tax obligations and employing a risk-based approach to audits.

Effective Use of Technology

Technology reduces administrative burdens on taxpayers, making it easier for them to comply while enhancing the efficiency and effectiveness of tax collection (OECD, 2020). The United Kingdom’s HM Revenue & Customs (HMRC) has embraced digital solutions to streamline tax processes. This includes online filing systems, real-time data sharing, and automated compliance checks. Most African countries have embraced the digital tax system, but it still faces very stiff challenges to producing optimal tax revenue.

Mechanisms for engagement and feedback

Engaging with taxpayers fosters a sense of ownership and involvement in the tax system, which can increase trust and compliance (Bahl & Bird, 2008). In Australia, the Australian Taxation Office (ATO) actively engages with taxpayers through surveys and consultations. The Australian Taxation Office (ATO) uses this feedback to improve services and address taxpayer concerns.

Education and Outreach Programs

Educating taxpayers about the tax system helps demystify the process, reduces anxiety around compliance, and promotes a culture of voluntary compliance (Luttmer & Singhal, 2014). Countries like Germany invest in taxpayer education programs that inform citizens about their rights and responsibilities. These programs often include workshops, seminars, and online resources.

Accountability Measures

By holding tax authorities accountable for their actions, increased accountability strengthens public trust in their operations (Pomeranz, 2015). The Netherlands has established independent bodies that audit tax authority performance and compliance with regulations. These bodies report findings to the public.

Responsive customer service

Taxpayers feel supported and can easily obtain help when needed, which improves their overall experience with the tax system and builds confidence (OECD, 2020). Countries like New Zealand focus on providing high-quality customer service through dedicated support channels for taxpayers. This includes responsive helplines and online chat services.

- IV) CONCLUSION

In conclusion, this write-up has provided empirical evidence on a significant decline in trust in tax revenue offices across Sub-Saharan Africa, which may be driven primarily by corruption, inefficiency, and lack of transparency in tax governance processes. This erosion of trust poses serious challenges to tax compliance and government revenue, potentially undermining economic stability in the region. Rebuilding confidence in tax systems in Sub-Saharan Africa as a whole and Cameroon in particular requires a comprehensive approach that incorporates transparency, fairness, technology, education, engagement, accountability, and responsive customer service.

To address issues related to the waning trust in tax revenue offices, we recommend that, it is crucial for policymakers to implement reforms that enhance transparency, combat corruption, and foster public engagement. By adopting these best practices from other countries, Sub-Saharan African nations can foster a more trusting and sustainably positive relationship between taxpayers and tax authorities, ultimately leading to improved compliance and revenue generation. While this study provides valuable insights, further research is needed to evaluate the effectiveness of these interventions based on the specific realities of each country and to explore similar dynamics in other regions.

References

Australian Taxation Office. (2021). Annual Report 2020-21.

Bahl, R., & Bird, R. (2008). Subnational Taxes in Developing Countries: The Way Forward. Public

Canada Revenue Agency. (2020). Taxpayer Advisory Panel Report. Retrieved from [CRA website](https://www.canada.ca/en/revenue-agency.html ).

Estonian Tax and Customs Board. (2021). Annual Report 2020. Retrieved from [ETCB website](https://www.emta.ee).

Federal Ministry of Finance, Germany. (2019). Tax Administration Report. Retrieved from [BMF website](https://www.bundesfinanzministerium.de ).

Feld, L. P., & Frey, B. S. (2002). Trust Breeds Trust: How Taxpayers Are Treated. Economics of Governance.

Olatunde Julius., Jia Liu., Sarah G., (2023). Tax Avoidance in Delveloping countries: Evidence in Sub Saharan Africa. Journal of financial crime, 27(2), 236-255.

Hibbs, D. A., & Locking, H. (2000). “Wage Restraint and Social Contract Theory.” European Journal of Political Economy, 16(4), 649-669.

International Monetary Fund (IMF). (2018). Fiscal Transparency: A Guide to the Principles.

Kimea, A.J., Mkhize,M., & Maama,H.(2023). The Sociocultural and Institutional Factors influencing tax Avoidance in SSA. Congent Business & Management, 10(1). https://doi.org/10.1080/23311975.2023.2186744

Luttmer, E. F. P., & Singhal, M. (2014). Tax Morale. Journal of Economic Perspectives.

New Zealand Treasury. (2020). Public Sector Financial Statements. Retrieved from [New Zealand Treasury website](https://treasury.govt.nz ).

OECD (2019). Tax Administration 2019: Comparative Information on OECD and Other Advanced and Emerging Economies.

OECD (2020). Tax Administration 2020: Comparative Information on OECD and Other Advanced and Emerging Economies.

OECD. (2020). Digital Government Strategies for Transforming Public Services in the Welfare Areas.

OECD. (2020). Tax Administration 2020: Comparative Information on OECD and Other Advanced and Emerging Economies.

Pomeranz, D. (2015). No Taxation without Information: Deterrence and Self-Enforcement in the Value Added Tax. American Economic Review.

Revenue Commissioners, Ireland. (2020). Annual Report 2019. Retrieved from [Revenue website](https://www.revenue.ie ).

South African Revenue Service. (2021). Annual Report 2020/21. Retrieved from [SARS website](https://www.sars.gov.za ).

Torgler, B. (2007). Tax Morale and Compliance Behavior: A Comparative Analysis. Journal of Economic Psychology.

Tsilly Dagan, (2024). Tax and Globalization: Toward a New Social Contract. Oxford Journal of Legal Studies, Volume 44, issue 3, pages 487-508.

World Bank (2020). Tax Compliance in Developing Countries: A Review of the Evidence.

Download the full Paper Here!

Trust-crisis-publication-LoRDA-OK.pdf (803 downloads )