A pilot study of the willingness of small size taxpayers to go digital: Feasibility of digitalization of council taxes

The breadth and speed of the change brought about by the digital transformation are notable and raise a large number of public policy challenges. The digital tax policy was adopted in Cameroon in 2014 (General Tax Code, 2014) and went concretely into effect in 2016, with all medium and large size business companies using the online declaration and payment system of the Directorate General of Taxation. However, despite this wave of change, local council tax declaration and payment in Cameroon have remained overly manual. It is in this respect that the Love Lead Research & Data Center (LoRDA) April 2022 conducted a pilot study to understand the willingness of small size taxpayers (small businesses), who are under the council tax base, to join the digital race. The range of taxes paid by these shops includes business license, liquor license, discharge tax, global tax, value-added tax, price control, ticket, etc. The study used a systematic sampling technique to randomly select shops at the main market Bamenda, Northwest Region Cameroon. The results obtained are as follows:

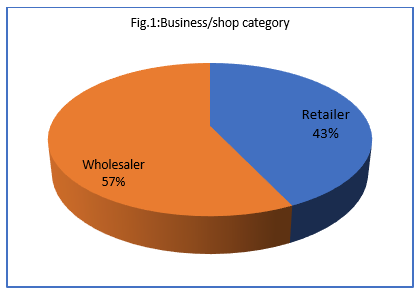

The study used a sample of shops with 57% wholesale and 43% retail businesses (Fig. 1).

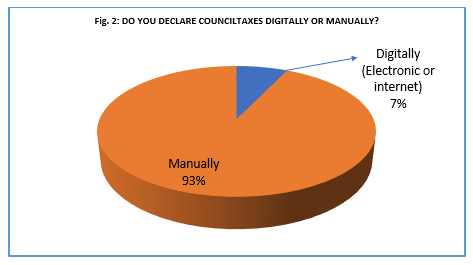

We found that 93% of businesses declare their council taxes manually compared to only 7% who declare digitally (Fig. 2).

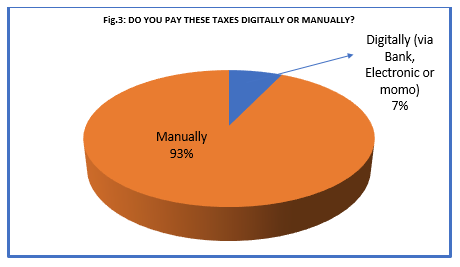

Again, we observed that 93% of businesses pay council taxes manually compared to only 7% who pay digitally. When we asked the type of tax paid digitally, they indicated council rent for the council owned shops, which is not a tax per se (Fig. 3).

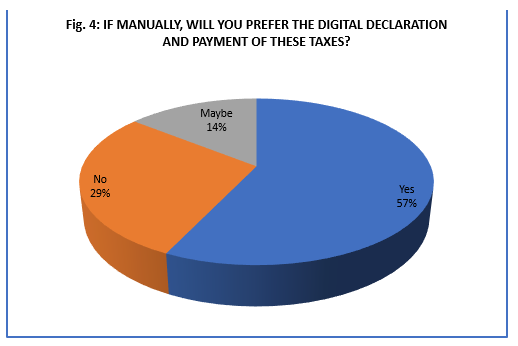

Figure 4 shows that majority (over 57%, considering maybe) of the small business (shops) at main market Bamenda will prefer to declare and pay the council taxes using the digital system. This is an important pointer for digitalization of taxation in the local tax system in the Northwest Region and the country as a whole.

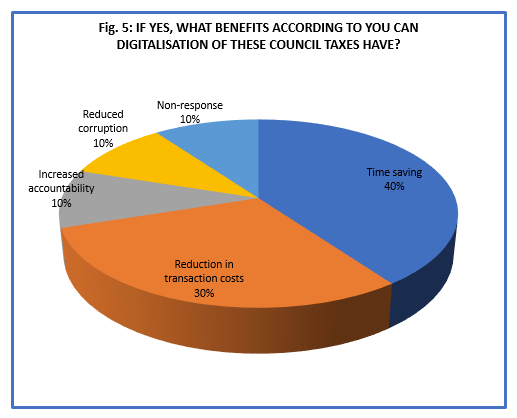

In Figure 5, majority indicated that digitalization of council taxes will be time saving (40%) and reduce transaction/compliance costs (30%) compared to only 20% who indicated that it will reduce corruption and increase accountability in councils. This is indication that the businesses are certain that the digitalization of council taxation will benefit them than it benefits the council authorities. The councils should leverage this and join the wave of digitalization.

In conclusion, there is a big opportunity for take-off of digitalization of local tax system as elicited by the results. Most importantly, informed knowledge underlines that the businesses are very certain that the digitalization of council taxation will benefit them than it benefits the council authorities.

Presented by: Dr. Ndamsa Dickson.

Citation: LoRDA (2022) Pilot study of the willingness of small size taxpayers to go digital: Feasibility of digitalization of council taxes,

https://lorda-researchcenter.org/pilot-study-of-the-willingness-of-small-size-taxpayers-to-go-digital-feasibility-of-digitalization-of-council-taxes/